Automation and smart engagement, without sacrificing the human touch.

Trusted by the UK’s top protection brokers

- Automate 100’s of tasks

- 50% ↓ your operational costs

- 3x ↑ your revenue per adviser

”Adviser.ai enables us to deliver conversions of up to 80% with 4 year clawback below 5%

Ollie PophamHead of Sales, Cavendish Online

”Adviser.ai plays a key role in our post-sale Consumer Duty, retention and review functions

Paul FoodyCEO, Lifesearch

”Adviser.ai has transformed the efficiency of our customer service and retention processes

Ian SawyerCommercial Director, Howden Life & Health

Take Control. Drive Growth. Empower Your Team.

Create higher quality enquiries

- Save time and get crucial insight on customer needs

- Ensure every customer genuinely wants a protection conversation

Take greater control sales processes

- Transform conversion and number of products per customer

- Prevent clawback and buyer’s remorse

Unlock value from your existing customers

- Build and maintain an ongoing relationship with every customer

- Secure crucial additional revenue

Elevate adviser peformance

- Identify and fix issues before they escalate

- Monitor and improve the detail of every customer engagement

Our core products

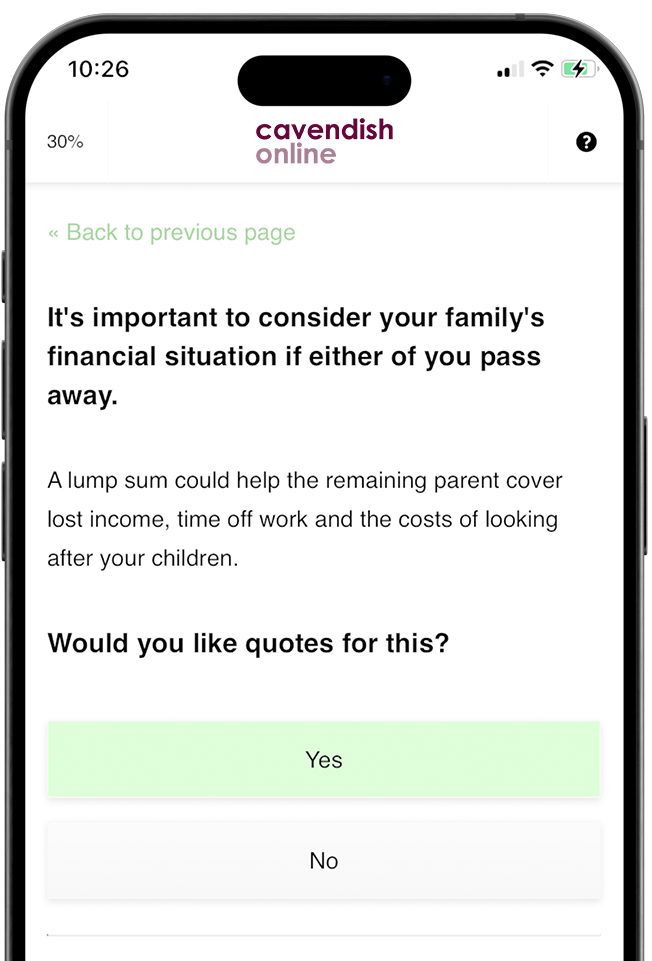

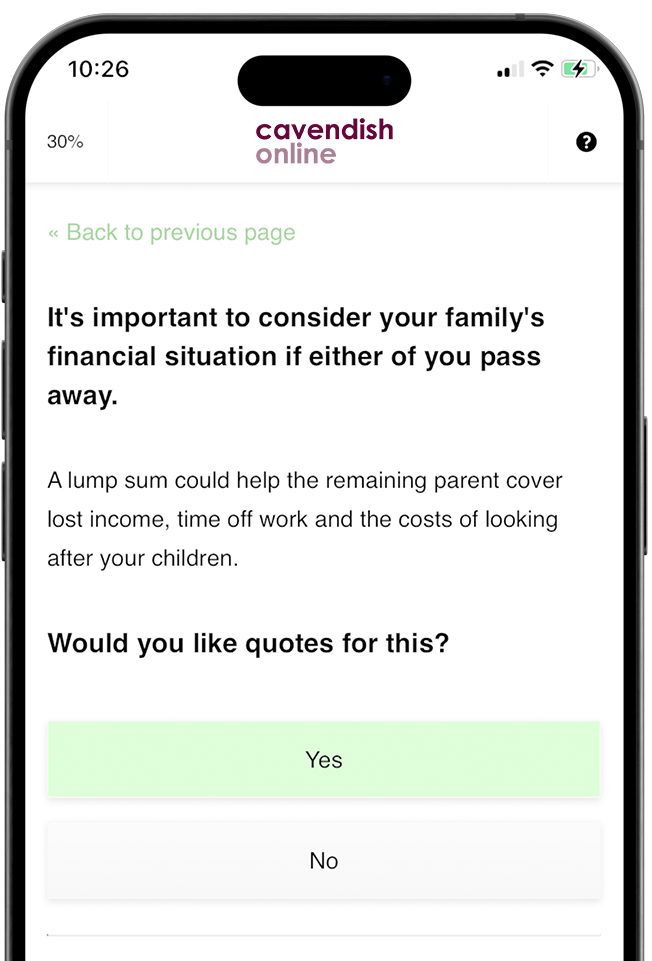

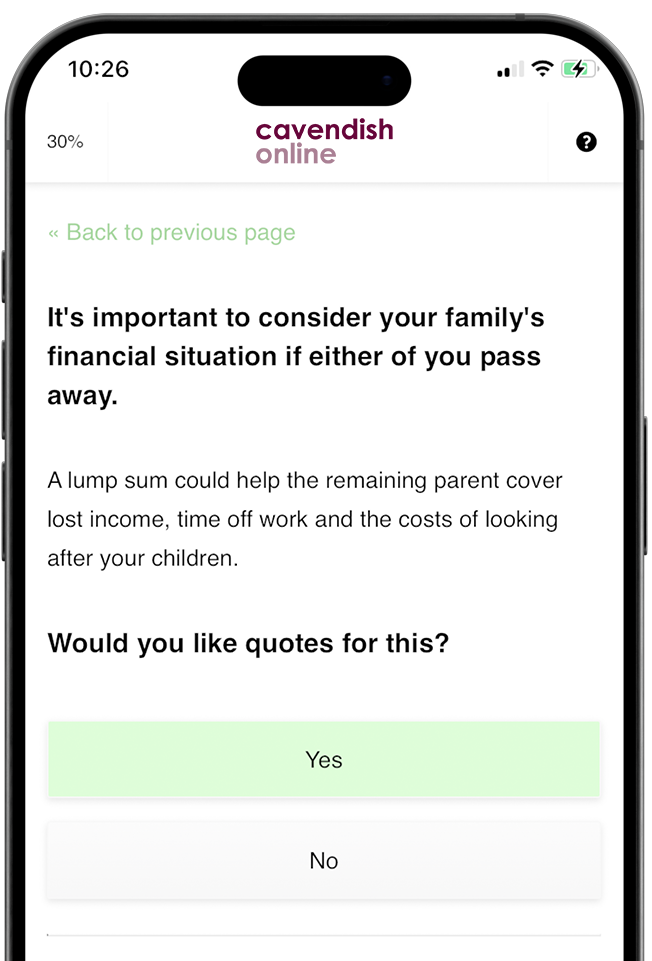

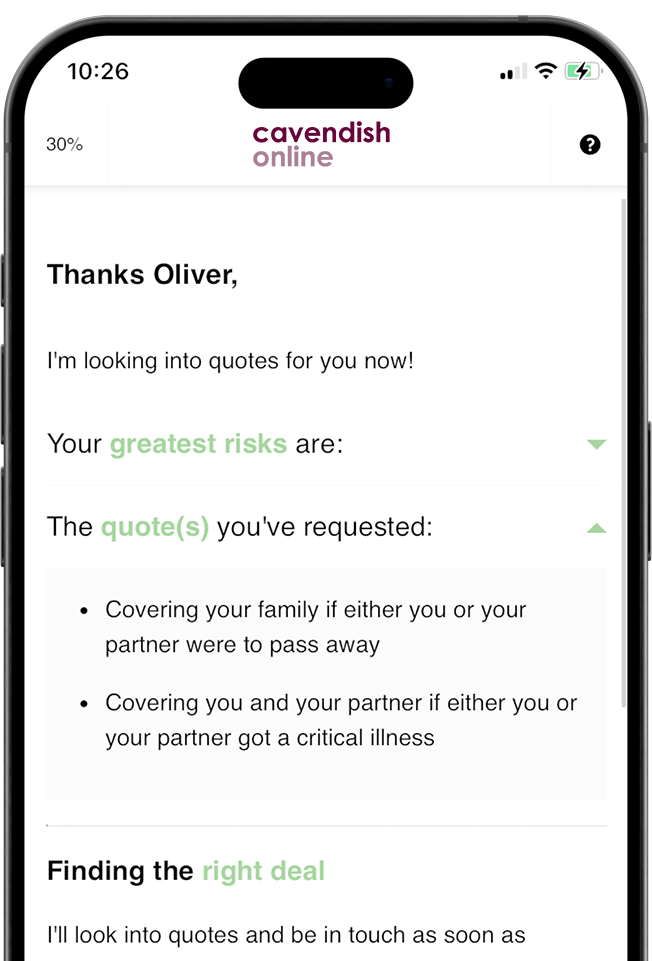

Digital Fact Finds

Intelligent Data Collection. Deeper Customer Insights

Our Digital Fact Find feature revolutionises how protection businesses gather customer information. Designed for speed, accuracy, and compliance, it replaces lengthly calls with a secure, guided digital journey — helping you understand your customer better and faster.

Save time and get crucial insight on customer needs and ensure every customer genuinely wants a protection conversation.

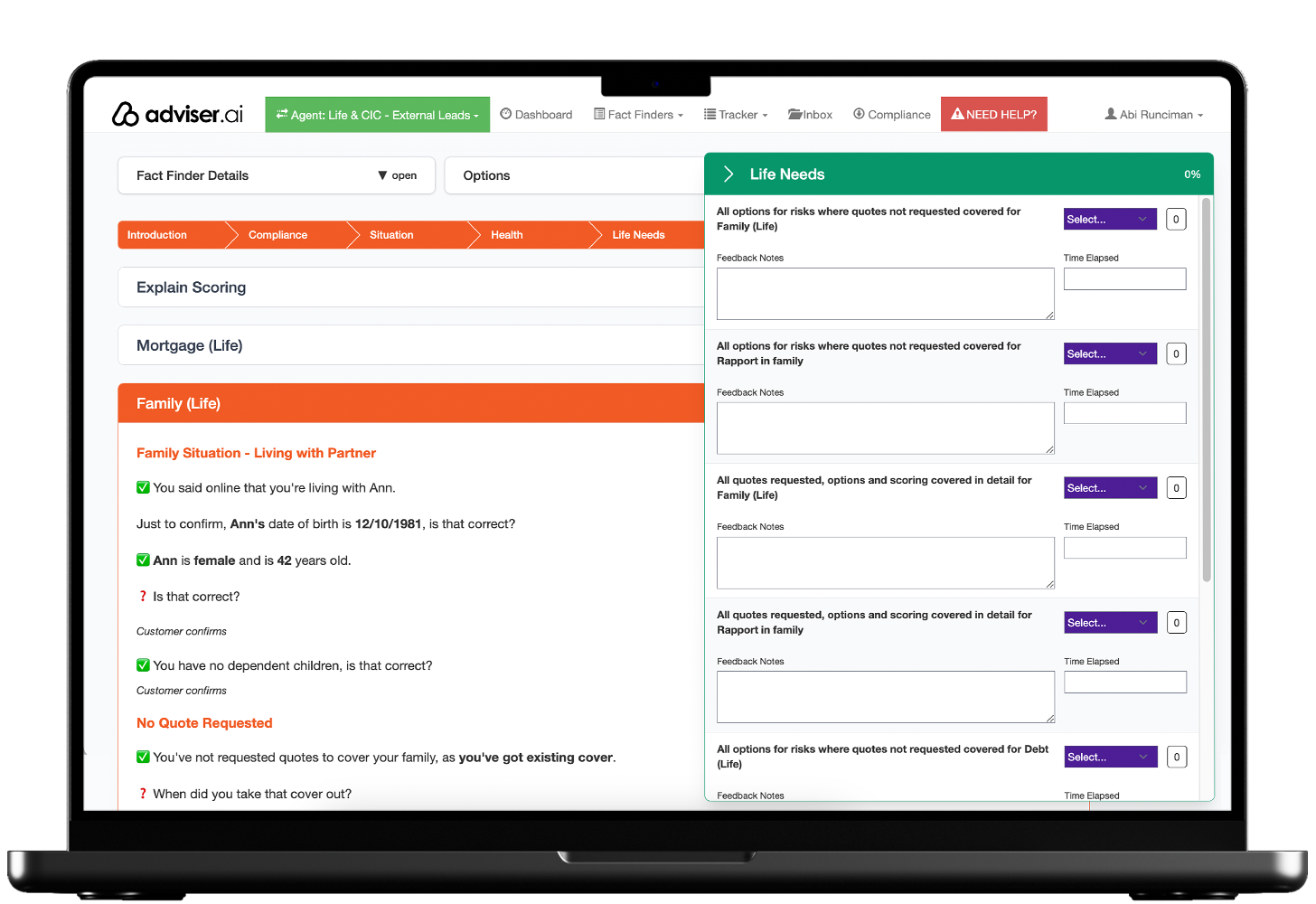

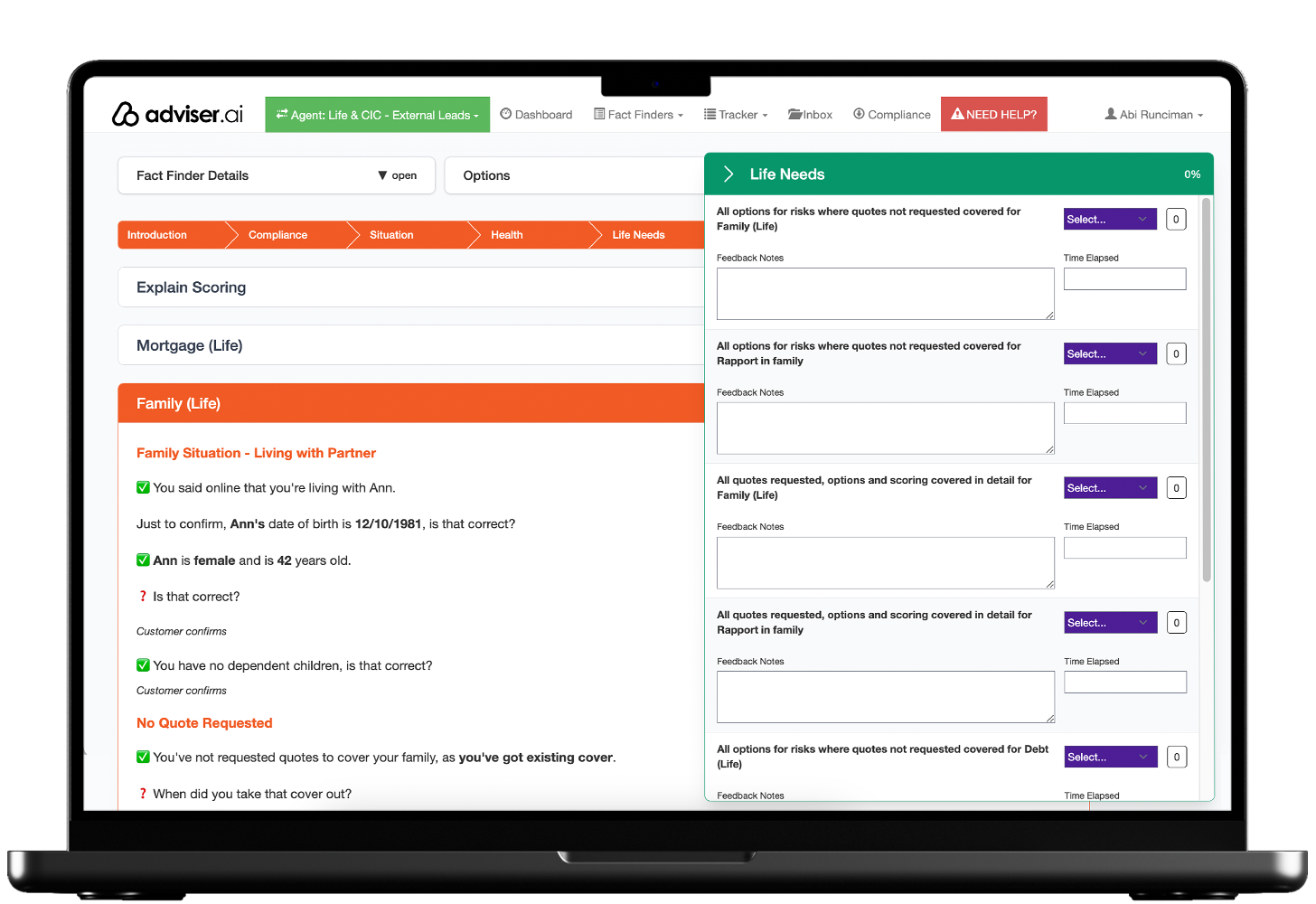

Digital Scripting

Drive Better Conversations with Intelligent Digital Scripting

The three main barriers for increasing sales for your protection business are trust, processes and time. Adviser.ai removes these barriers. Our Digital Scripting tool guides protection advisers through structured, compliant, and highly effective conversations. With a customer-first design, it builds trust while ensuring every conversation is consistent, engaging, and outcomes-driven.

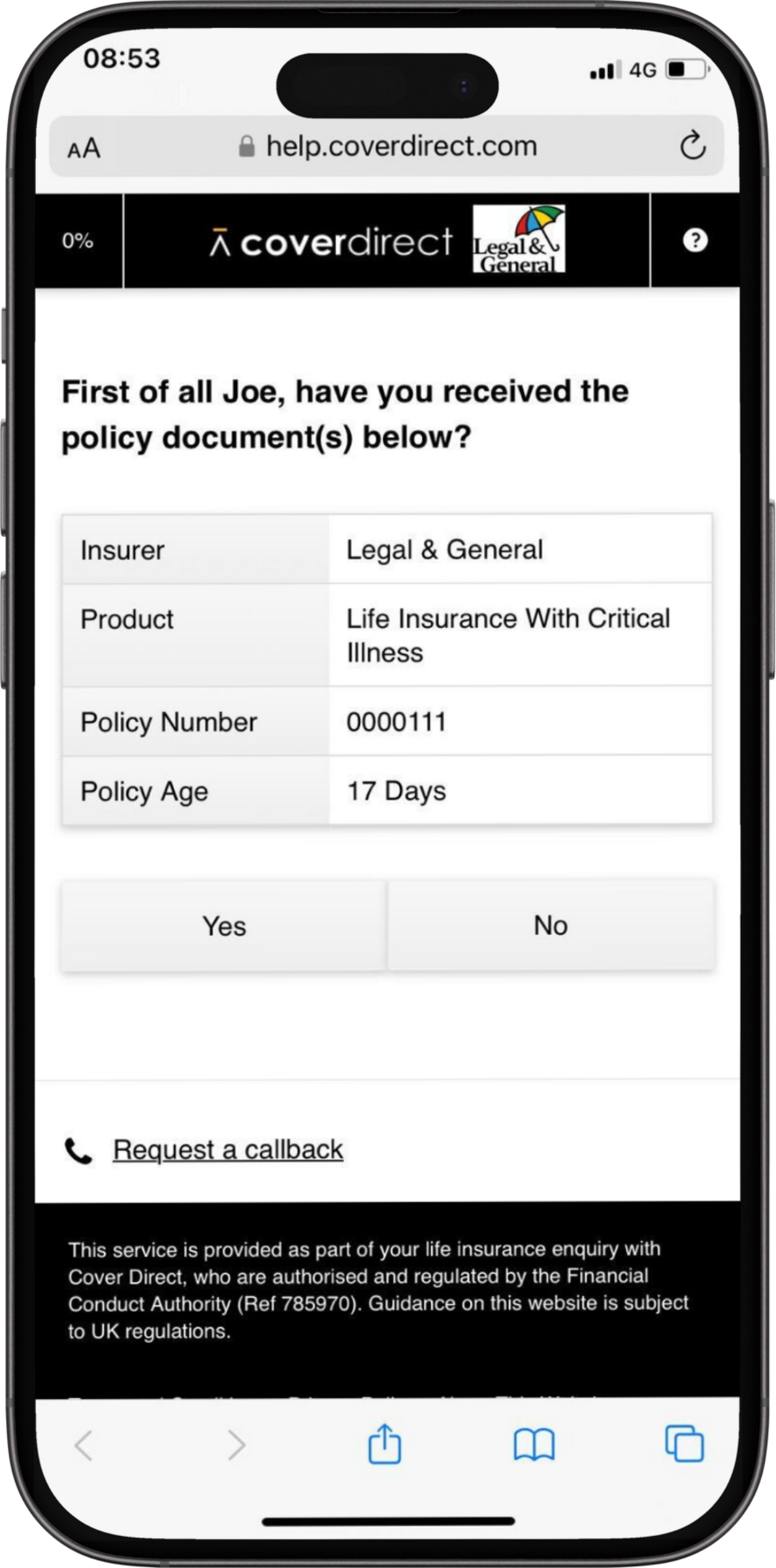

Post-Sale Check & Report

Simplify Post-Sale Checks, Reduce Admin, and Keep Customers Informed — Effortlessly.

Post-Sale Check automates customer follow-up, improves policy understanding, and collects real-time service feedback — all while reducing admin, supporting compliance an driving customer trust. Seamlessly integrated into your workflow, it’s smart, scalable, and built to elevate your customer experience.

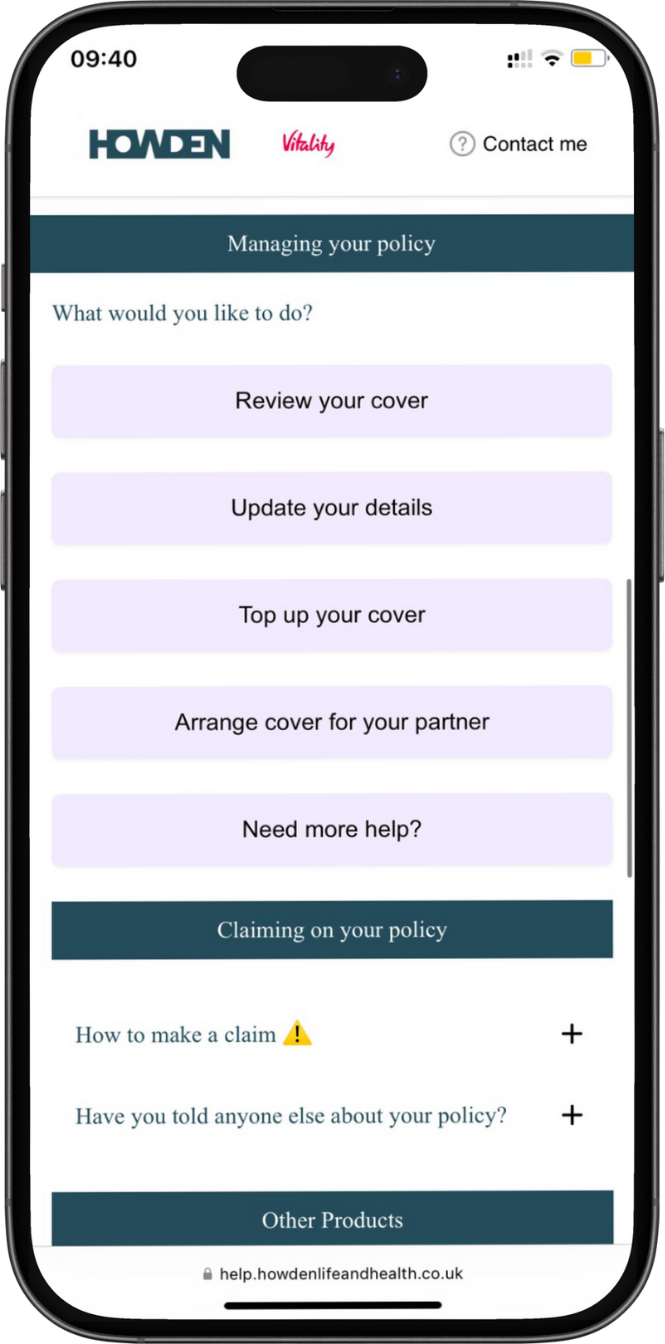

Cover Review

Automated Policy Reviews That Drive Engagement, Compliance, and New Business

Automate client outreach, uncover life changes, and receive high-intent review requests — all while supporting compliance, boosting retention, and unlocking cross-sell opportunities.

Benefit Reminders

Stay Front-of-Mind, Drive Engagement, and Unlock New Opportunities.

Timely, automated Benefit Reminders deliver personalised, adviser-branded messages that highlight policy value, strengthen trust, and open the door to referrals and cross-selling — all while supporting compliance and reducing admin.

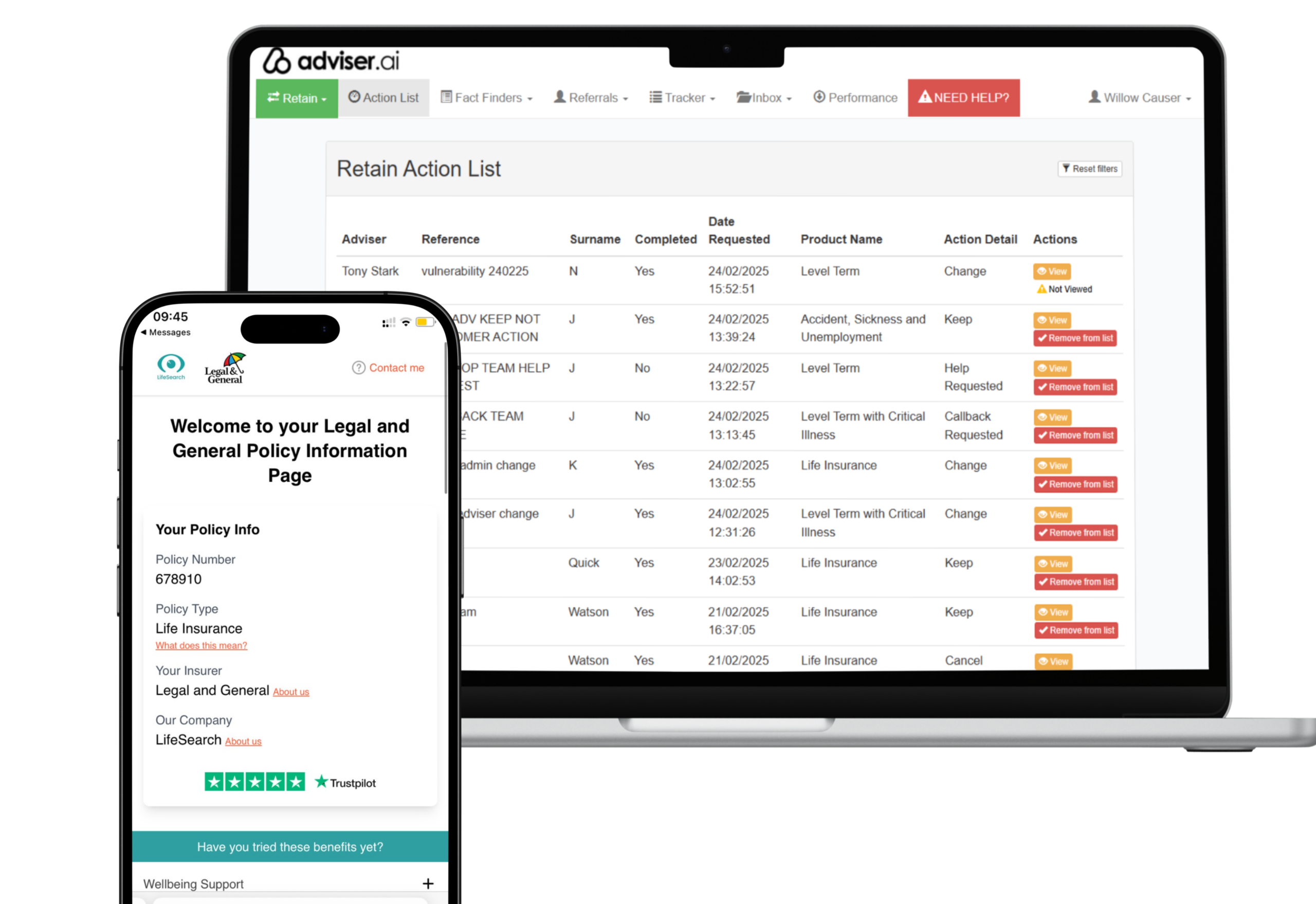

Retention

Reduce Lapses and Clawbacks with Smart Retention Workflows

Automatically engage at-risk customers when payments fail, diagnose issues online, and re-engage them efficiently — lowering costs, protecting revenue, and boosting retention.

Digital Fact Finds

Intelligent Data Collection. Deeper Customer Insights

Our Digital Fact Find feature revolutionises how protection businesses gather customer information. Designed for speed, accuracy, and compliance, it replaces lengthly calls with a secure, guided digital journey — helping you understand your customer better and faster.

Save time and get crucial insight on customer needs and ensure every customer genuinely wants a protection conversation.

Digital Scripting

Drive Better Conversations with Intelligent Digital Scripting

The three main barriers for increasing sales for your protection business are trust, processes and time. Adviser.ai removes these barriers. Our Digital Scripting tool guides protection advisers through structured, compliant, and highly effective conversations. With a customer-first design, it builds trust while ensuring every conversation is consistent, engaging, and outcomes-driven.

Post-Sale Check & Report

Simplify Post-Sale Checks, Reduce Admin, and Keep Customers Informed — Effortlessly.

Post-Sale Check automates customer follow-up, improves policy understanding, and collects real-time service feedback — all while reducing admin, supporting compliance an driving customer trust. Seamlessly integrated into your workflow, it’s smart, scalable, and built to elevate your customer experience.

Benefit Reminders

Stay Front-of-Mind, Drive Engagement, and Unlock New Opportunities.

Timely, automated Benefit Reminders deliver personalised, adviser-branded messages that highlight policy value, strengthen trust, and open the door to referrals and cross-selling — all while supporting compliance and reducing admin.

Cover Review

Automated Policy Reviews That Drive Engagement, Compliance, and New Business

Automate client outreach, uncover life changes, and receive high-intent review requests — all while supporting compliance, boosting retention, and unlocking cross-sell opportunities.

Retention

Reduce Lapses and Clawbacks with Smart Retention Workflows

Automatically engage at-risk customers when payments fail, diagnose issues online, and re-engage them efficiently — lowering costs, protecting revenue, and boosting retention.

Quotes that inspire us

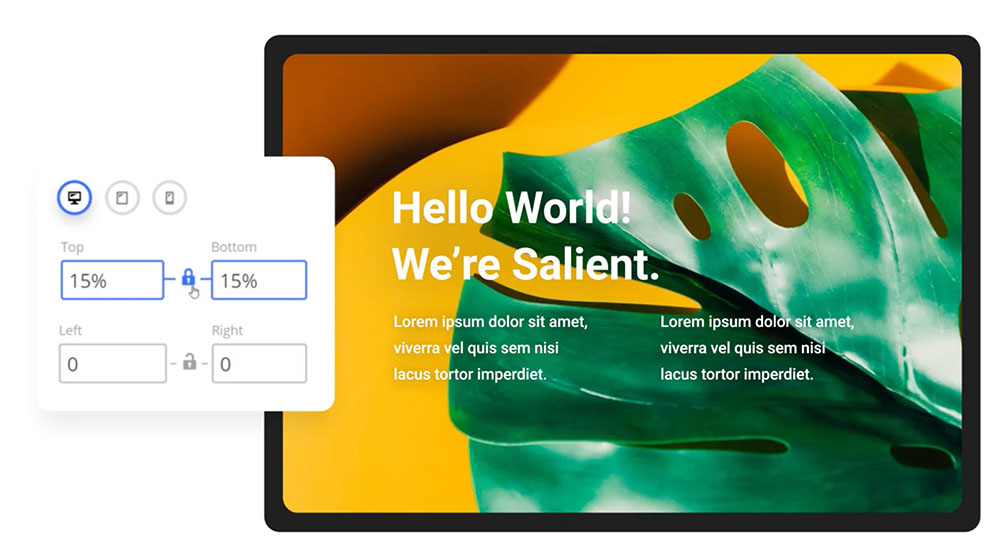

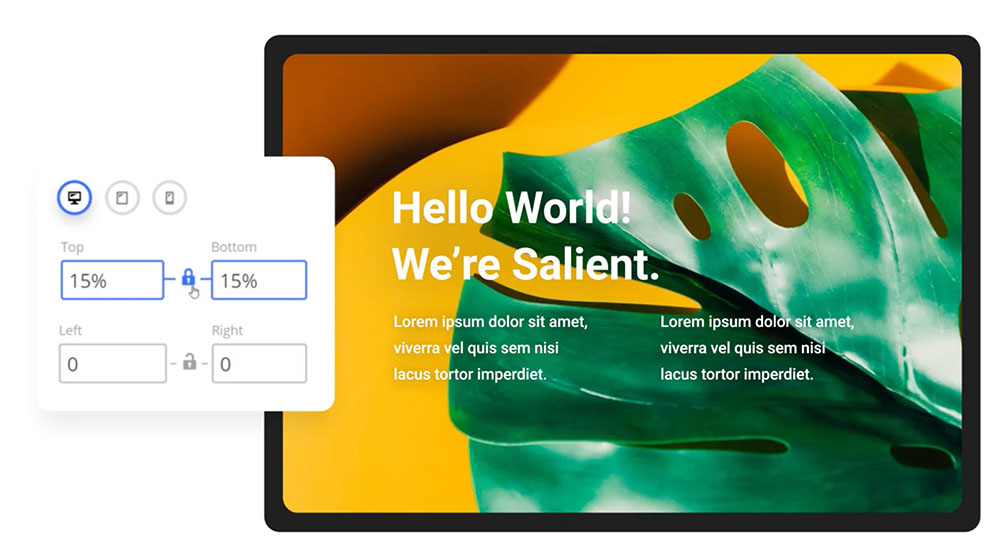

Tailor seamless cross-platform journeys

“A one-size-fits-all customer journey is not good enough. Switching between online and offline, ensuring journeys and experiences are designed around customer needs, is crucial.”

Debbie Kennedy, CEO, Lifesearch

Innovation drives the protection industry

“Technological innovation is the driving force behind most industries, and none more so than protection.”

Ian Mckenna, Founder, Financial Technology Research Centre

Financial advice needs a fundamental rethink

” The next generation of financial advice cannot be built on marginal efficiencies alone. It requires a fundamental rethinking of how advice is delivered.”

Paul Yates, Product Strategy Director, iPipeline

The team behind adviser.ai

Adviser.ai is a security first company.

Protecting sensitive client data is at the heart of everything we do. Our platform is built with robust, end-to-end security controls designed to meet the highest industry standards — so you can focus on growing your business with total confidence.

ISO 27001 Certified

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus amet

99.9% platform uptime

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus amet

Data Protection by Design

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus amet

Operational Security

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus amet

What does CRM mean?

CRM stands for Content Relationship Management. Using a CRM platform gives everyone involved in your business a way to manage customer interactions to increase growth.

Is it really free to start?

Yes! You can opt to stay within the free tier for as long as you want to. It’s a great way to get a feel for the platform before deciding to upgrade to take advantage of the more advanced features.

Can I import data?

Yes! Getting your existing data in is easy. Simply export your existing customers to a .csv file and import them within a couple of clicks.

FAQ’s

Hopefully our website has answered most of your questions about Adviser.ai. If not, here are some common questions we field about our product.

"A must-have"

“A game-changer”

“Awesome”

“Adviser.ai is great”

Meet the Founder

Adviser.ai is the brainchild of protection geek, Luke Ashworth

“There can’t be many other people as passionate and experienced at the coal face of the protection industry”

Mike Pritchard

Find out how we can help your business

The ultimate toolkit for protection professionals. Build a culture of excellence and maximise every opportunity.