Digital Fact Finds

Turn pre-sales into high-intent, trust-driven conversations

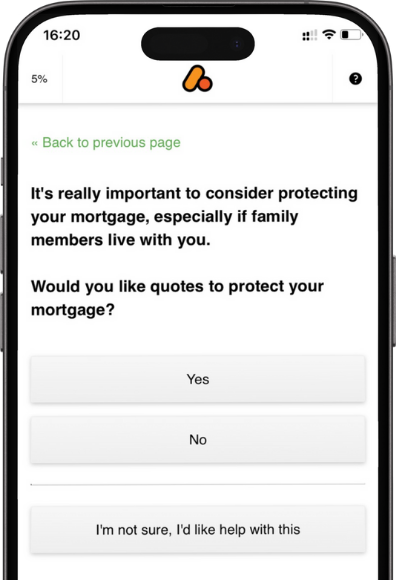

The Digital Fact Find is a powerful engagement tool that replaces outdated first-contact methods like cold calls. It helps your customers identify their protection needs, understand their options, and build trust, all before the first sales conversation begins.

Transform Your Pre-Sales Process With Smarter Conversations

- By replacing traditional, pushy sales openers with an educational and customer-led experience, Digital Fact Find helps customers feel in control, not pressured. This builds trust before the first conversation even begins.

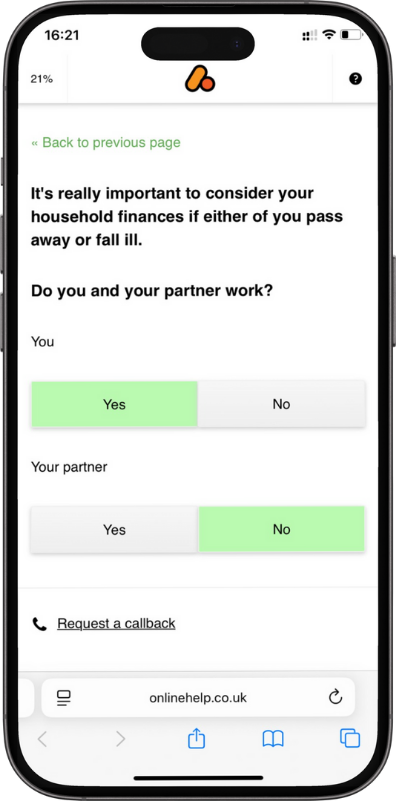

Improves customer understanding

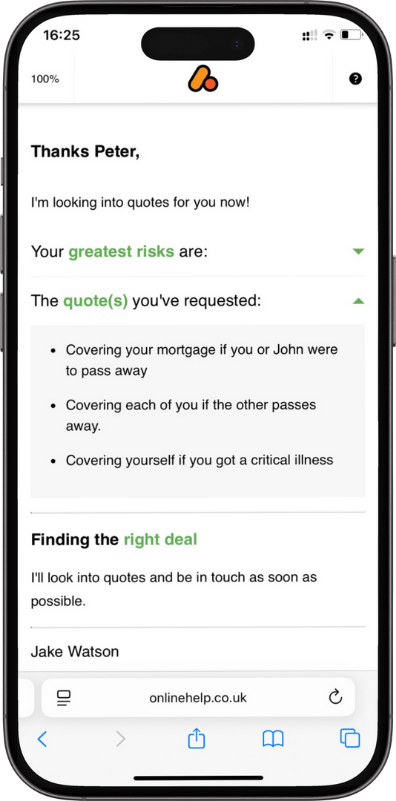

- Customers are informed about their own risks and options, making sales conversations more effective. This increases buying intent, reduces objections, and leads to higher-quality conversions.

Saves advisers time and focuses the call

- By collecting and organising key insights in advance, the Digital Fact Find allows advisers to skip the admin and jump straight into personalised advice, making each call more efficient and impactful.

Reduces clawback and strengthens retention

- When customers understand exactly what they’re buying and why, they’re less likely to cancel or lapse. This lowers clawback and improves long-term policy retention.

Why It Matters

Nobody likes being “sold to”, so we designed a better way

Traditional sales processes often cause drop-off before conversations even start. Customers feel “sold to”, trust is low, and product understanding is weak. The Digital Fact Find solves this by creating an educational, personalised experience that increases intent and dramatically improves outcomes.

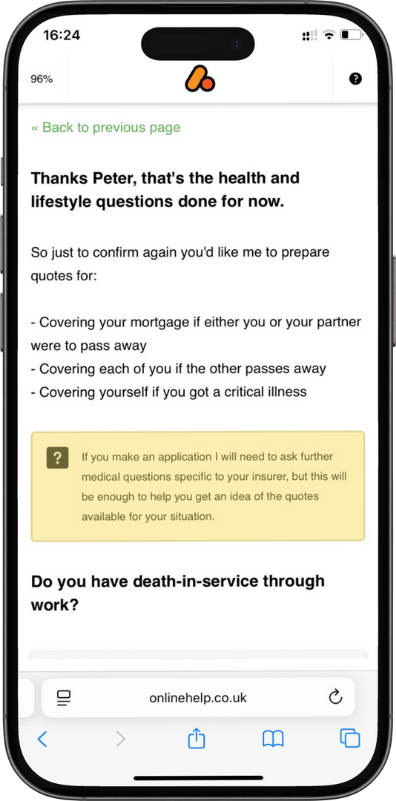

What It Does

Save time and get crucial insight on customer needs and ensure every customer genuinely wants a protection conversation

- Builds trust before you call – Guide customers through a personalised, adaptive journey that helps them feel in control, not sold to.

- Educates and engages – Customers gain real understanding of their protection needs in relation to their personal circumstances, so they’re ready for meaningful discussions.

- Saves adviser time – By gathering key insights and preferences in advance, your team can focus every minute of the call on getting customers covered, not cold calls.

- Reduces clawback, boosts conversion – When customers understand what they’re buying and why, they’re more likely to stay protected long-term.

How It Works

Built For Every Situation

Seamlessly fits into every step of your sales process

- Before protection sales appointments

- As part of the mortgage application process

- During referral follow-ups

- Embedded in marketing campaigns

- On your website or landing pages

- Continued support post-sale

Find out how we can help your business

Automation and smart engagement, without sacrificing the human touch.