Digital Scripting

The intelligence behind every great protection conversation

Our Digital Scripting gives your team tailored conversational guidance that adapts in real time to each customer’s needs. Powered by data from the Digital Fact Find and infused with advanced sales psychology, it helps advisers build trust, improve customer understanding, increase conversions, and stay fully compliant.

Built to Scale Trust, Compliance & Sales

- Delivers real-time, tailored prompts based on each customer’s fact find responses — making every conversation feel natural, relevant, and customer-first.

Effortless compliance, built-in

- Turns regulatory steps into trust-building moments and eliminates missed disclosures, helping advisers stay fully compliant without the stress.

Faster preparation, smarter sales

- Build and maintain an ongoing relationship with every customer

- Secure crucial additional revenue

More opportunities, better outcomes

- Uncovers missed quote opportunities, prioritises needs using risk scoring, and boosts multi-product sales without pressure or pushiness.

How It Works

Turn every protection conversation into a high-conversion, compliance-ready experience

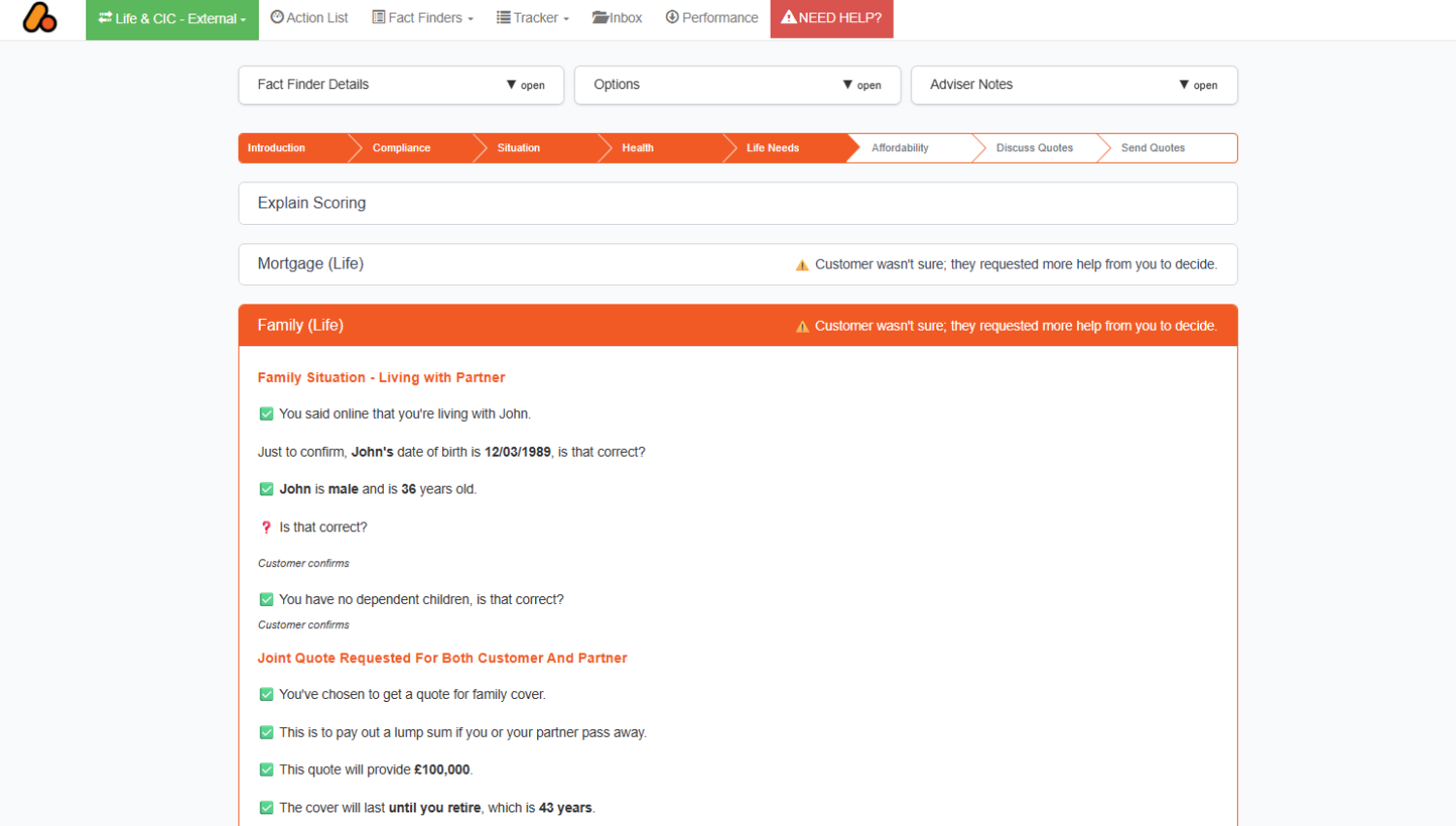

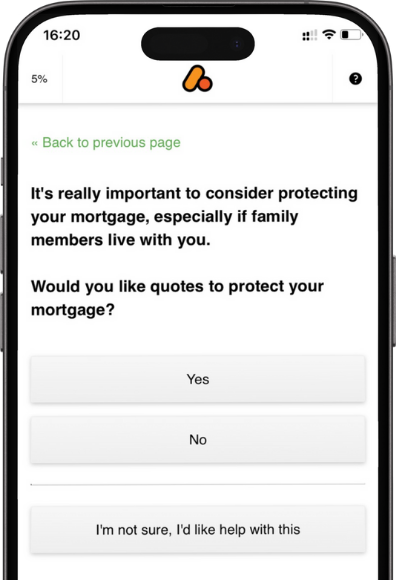

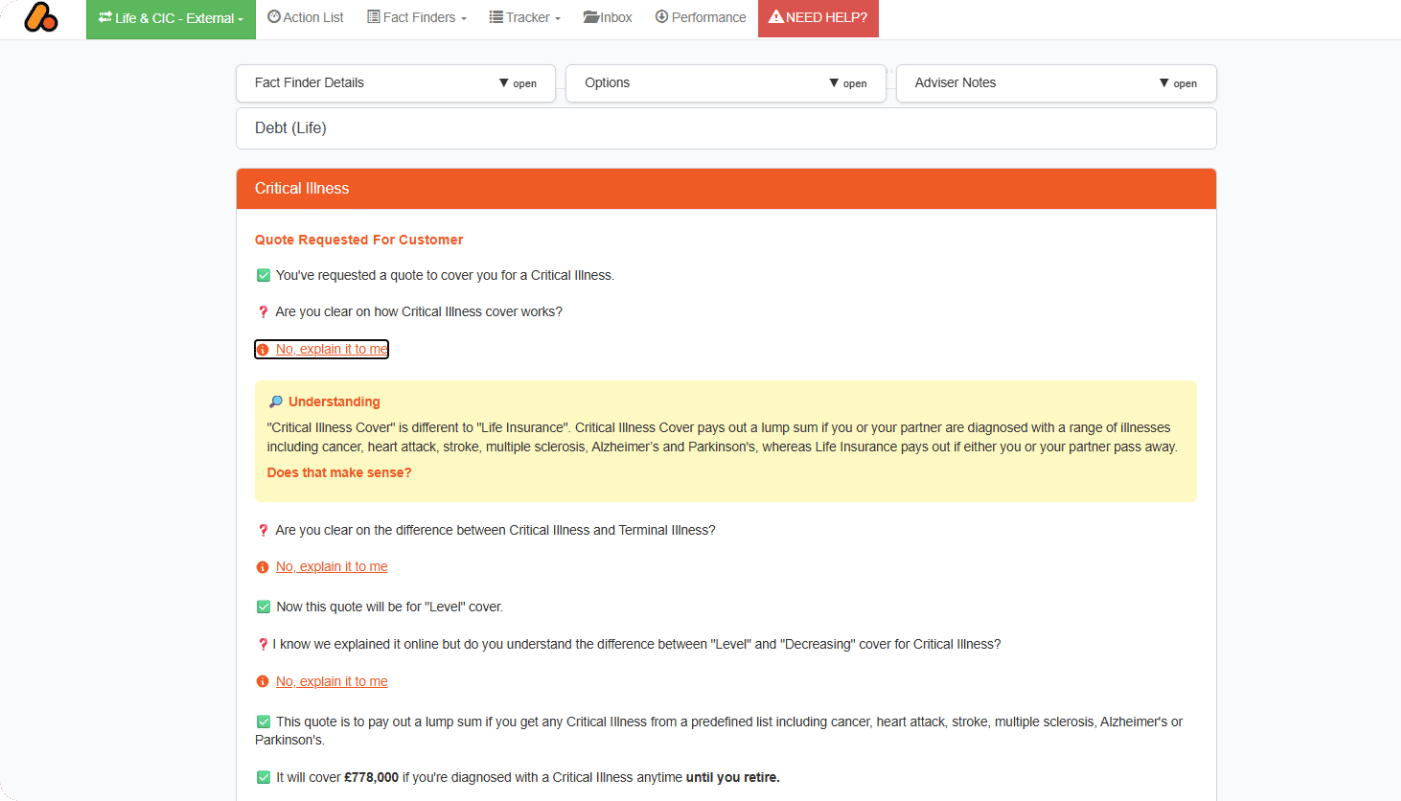

As your customer completes the Digital Fact Find, Digital Scripting automatically structures the adviser’s upcoming conversation for maximum impact. Each tab in the dashboard aligns with a key stage of the call and provides dynamic prompts tailored to the customers responses.

Adviser Dashboard

Seamless integration with the Adviser Dashboard

Every prompt, every recommendation, and every compliance reminder is embedded in the Adviser Dashboard, your team’s all-in-one workspace for high-performance protection sales.

Key Tabs & Features

Explore the key features of the Adviser Dashboard.

Introduction

- Seamlessly transitions from the digital fact find

- Establishes trust and confidence early

- Avoids early “sales flags” with warm, customer-first language

Compliance

- Transforms mandatory disclosures into trust-building moments

- Reinforces your business’s value while meeting all regulatory needs

- Prompts security verification and confirms customer understanding

- Highlights vulnerabilities and flags from the fact find

Situation

- Reviews qualifying factors like nationality, residency, or language barriers

- Helps advisers tailor tone, pace, and product discussions appropriately

Health

- Surface health and lifestyle data gathered online (BMI, alcohol, diabetes, etc.)

- Guides advisers on when and how to raise sensitive health topics

- Includes expert tips to reinforce credibility and empathy

Life Needs

- Covers all identified risks: mortgage, income, family, debts, critical illness

- Helps advisers revisit missed quote opportunities without sales pressure

- Includes embedded definitions and visual cues for clarity

- Incorporates Risk Scoring to prioritise customer needs and buying intent

Affordability & Income Protection

- Calculates disposable income using customer’s outgoings and sick pay info

- Uses “financial shortfall” modelling to build IP need awareness before introducing products

- Explains complex Income Protection features in a simple, confident way

- Avoids sales flags by using needs-based prompts

Discuss Quotes & Send Quotes

- Guides advisers through quote discussions in order of customer priority

- Live quote bar helps manage budget awareness

- Allows flexible editing of cover amounts and quote options

- Creates pre-formatted quote emails and texts with attached documents

- Highlights any uncovered risks to reinforce compliance

Find out how we can help your business

Automation and smart engagement, without sacrificing the human touch.