No one likes being sold to, especially when being sold life insurance. In fact, the harder you try to highlight the need for life insurance to each of your clients, the greater the chances of your clients losing trust in your mortgage advice.

It’s not your fault. It is an industry-wide issue. Most people don’t trust anyone selling life insurance.

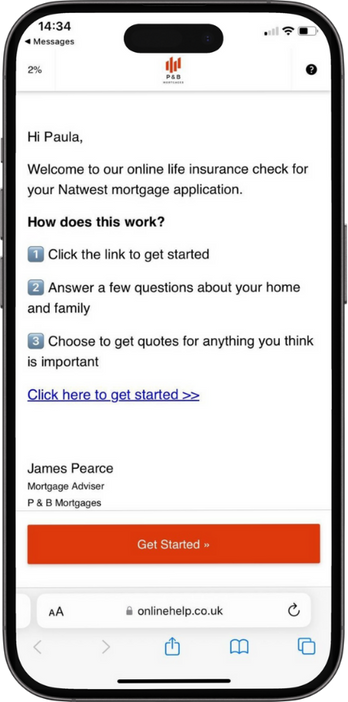

At Adviser.ai we solve this problem. Adviser.ai ensures that all your mortgage clients get a chance to consider their protection needs, but without feeling “sold to”.