Cover Review

Maximise customer engagement and drive policy review opportunities

Save time and transform your review conversion. Easily reconnect with customers, uncover changes in their circumstances and priorities, and generate high-quality review opportunities.

Turn Policy Reviews Into High-Value Customer Conversation

- Deliver adviser-branded messages via email and SMS that feel personal. Automate multi-month campaigns that drive engagement without the time-consuming admin

Understand customer changes

- Customers can quickly update their life circumstances online, revealing natural review triggers like mortgage changes, income shifts, or new family needs

Create high-intent conversations

- Use your dashboard to guide the review conversation with context. Focus on what’s changed and deliver relevant, trusted solutions

Compliantly build trust and loyalty

- By signposting benefits and offering regular reviews, you keep customers informed, reassured, and connected to your brand, not just the policy

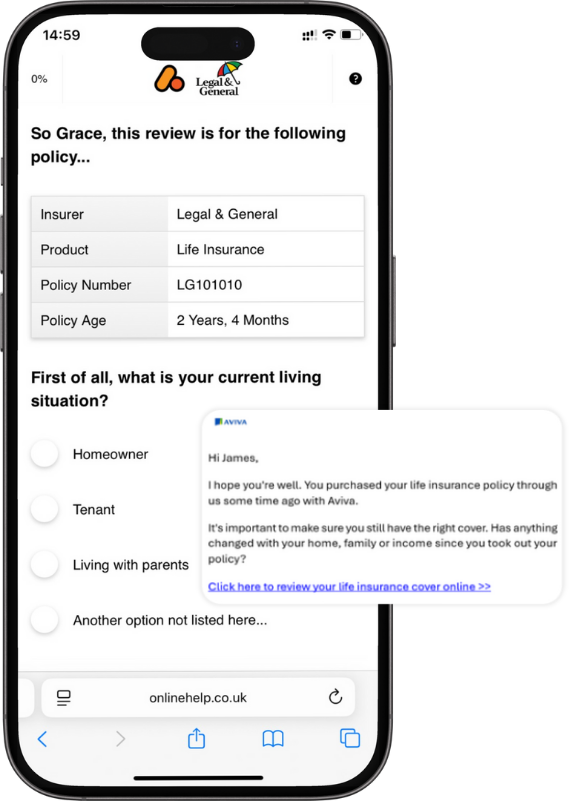

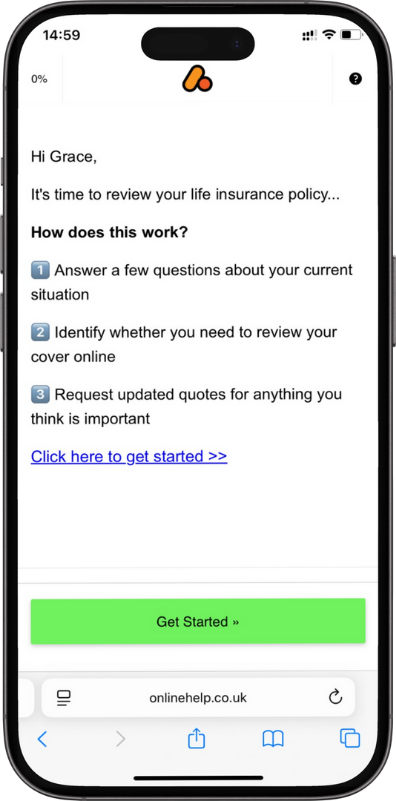

Personalised Campaigns

Send personalised marketing campaigns to your existing customers by email & SMS

- Schedule automated campaigns for up to 6 months

- Messages written as if individually created by and delivered from your Advisers

- Integrated email and SMS messages, developed by protection conversion experts

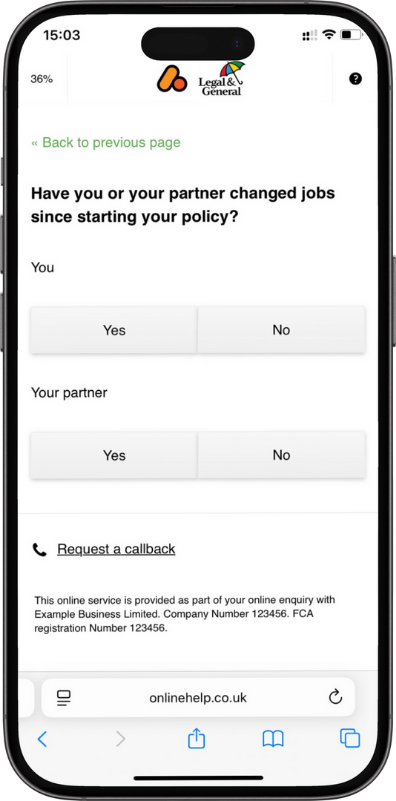

Review Changes

Customers conveniently review changes to their situation online

Enable customers to identify changes to their circumstances since taking out their existing cover

Receive high-intent requests from customers who have agreed to a review

- Customers can identify changes to their situation (e.g. mortgage, income, family, home, health, smoker status)

- Discover potential issues… (e.g. deterioration in health, smoker status, hazardous activities)

- Customers then request a call from you to discuss their situation and look into potential updates to their cover

Build Trust

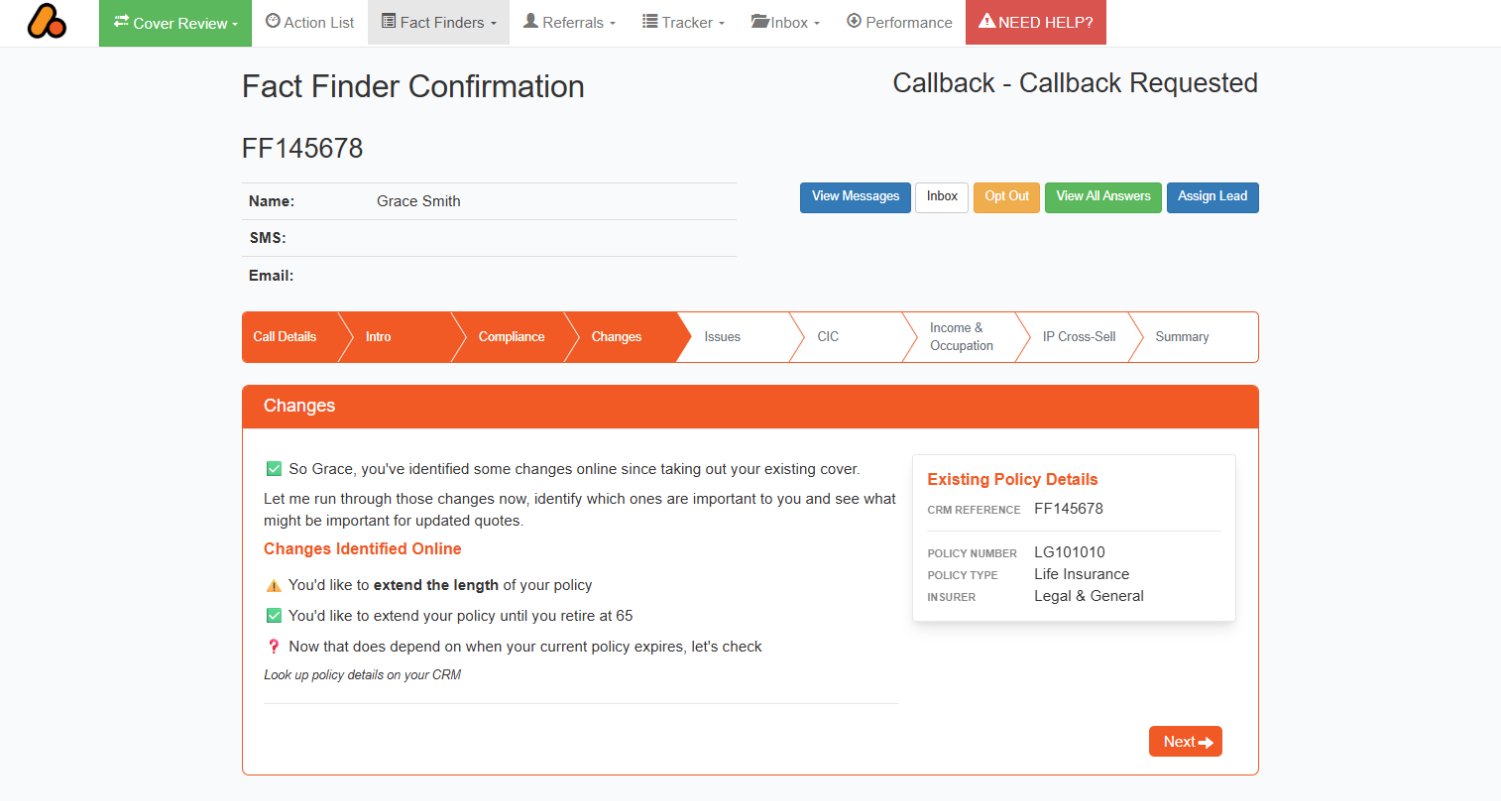

Discuss changes and identify areas for updated quotes & cross-selling

- Use the signposting in the Adviser Dashboard to discuss their changes in more detail, identify the most important and provide updated quotes where required

- The Dashboard creates a natural “flow” between the action the customer has taken online and your subsequent conversation with them

- The Dashboard enables you to spend far more time rebuilding your trust and relationship with the customer before looking at updated quotes

- Easily enables cross-selling of additional policies such as Critical Illness and Income Protection

Track Responses Instantly

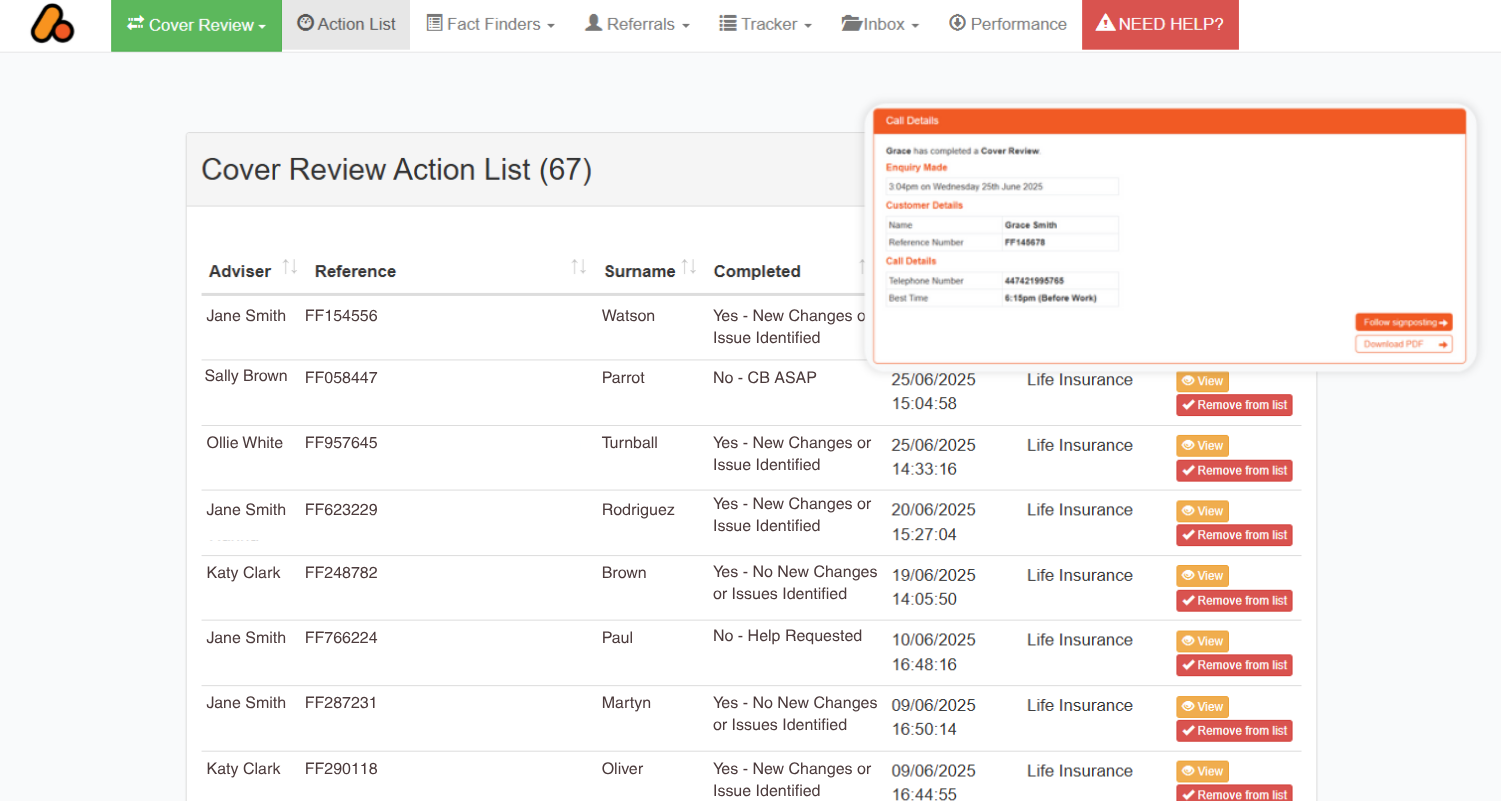

View all responses in your Adviser Dashboard

- Filter completed Cover Reviews by action required

- View summary details of completed Cover Reviews

- Access all customer answers by selecting view all answers

Find out how we can help your business

Automation and smart engagement, without sacrificing the human touch.